COP26: Success is the Only Option

2021-08-05 by Neil Simpson

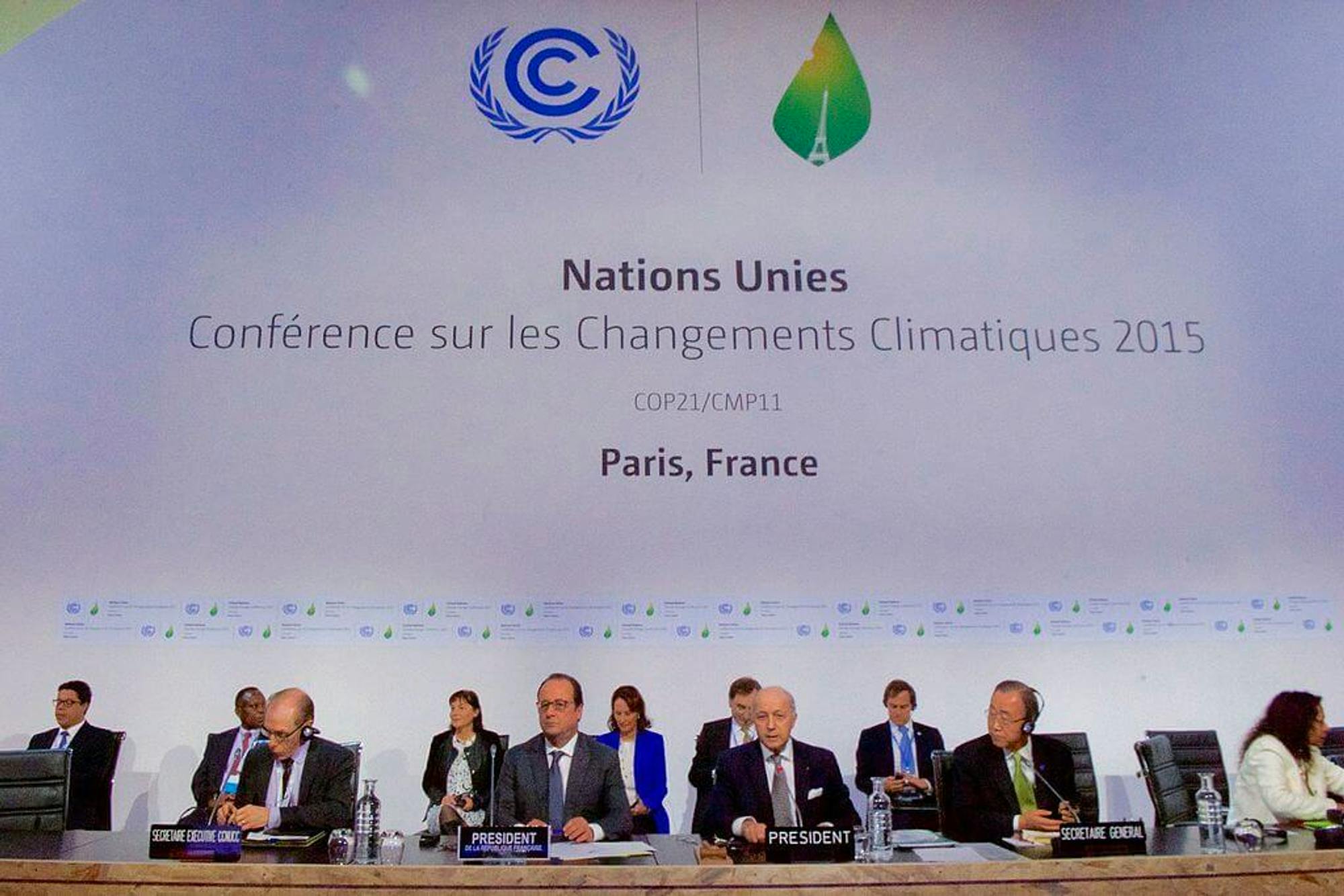

World leaders gather to negotiate the Paris Climate Accord in 2015 [source]

If you’re familiar with the term COP26, you probably feel like it’s been talked about for so long that it must already be over. Well, after a 12-month Covid-19 postponement, COP26 is on the horizon: October 31 to November 12, in Glasgow.

What is COP26?

COP ("Conference of the Parties") sees 196 countries and the EU gather to honour 1994's UN Framework Convention on Climate Change (UNFCCC), a treaty that aims to reverse man-made climate change. Due to international inaction, the scientific consensus is that our greenhouse gas emissions must drop sharply, now. If COP26 doesn't result in radical commitments and immediate action, we face runaway, catastrophic global heating.

The link between COP26 and banking

The UN is clear that such action is only achievable if the financial sector drastically changes course. In the COP26 literature it says private-sector banks, as well as “insurers, investors, and other financial firms”, must commit to “ensuring their investments and lending is aligned with net zero.” In other words, banks must cease investing in and lending to the fossil fuel industry, because such activities are not compatible with net zero. In fact, these activities are a massive contribution to the climate crisis.

Promising developments

The International Energy Agency (IEA) was founded in 1947 as an effort between countries (currently 30) to tackle widespread energy insecurity, such as that experienced during the Gulf War oil shortages; given that the world has been so reliant on the stable supply of fossil fuels for so long, the IEA has historically been a great enabler of the industry. Not anymore. In May, it released its global "Roadmap to Net-Zero Emissions by 2050", calling for a future dominated by renewable energy. It includes this radical point:

"From today, [there can be] no investment in new fossil fuel supply projects, and no further final investment decisions for new unabated coal plants."

Meanwhile, the World Economic Forum has published Climate Breakthroughs: The Road to COP26 and Beyond. It demands that companies set out the near-term action needed to ultimately achieve net zero, like investing in reforestation, peatland restoration, and other carbon sinks. The report states that:

"We welcome any company with high climate ambitions to join us and help build momentum. We welcome engagement from the investors and funders that will finance this transition."

Companies – and that means banks – must plant their net-zero seeds in some seriously good fertilizer.

The commitments we need from banks

Environmental activists protest in Europe [source]

COP26 is scheduled for 31 October to 12 November, which means there are roughly three months during which the financial sector must finally step up and pull its weight. There will be all sorts of commitments and green grandstanding between now and then, but what actually needs to happen? Here are a few essential requirements:

- All central banks must stop financing the expansion of fossil fuels.

- All banks must start reporting the emissions generated as a result of their lending (known as "scope 3" emissions), not just those generated by the bank themselves ("scope 1 or 2" emissions).

- Industry regulators must start recognizing that the climate crisis is a risk to the entire financial system, then regulate accordingly.

- Banks must no longer be allowed to finance fossil fuel expansion projects and the companies behind these projects.

The Net Zero Banking Alliance

Mark Carney attends a G20 meeting in 2018 [source]

The good news is the private finance sector doesn't have many places left to hide. Mark Carney, former Bank of England governor and current UN Special Envoy for Climate Action and Finance, made a 2020 speech dedicated to preparing the sector for what it's expected to bring to the COP26 table.

Carney’s key message was that "every company, bank, insurer, and investor will have to adjust their business models, develop plans for the transition [to net zero] and implement them". It doesn’t get clearer than that.

To bring this effort into the mainstream, the UN has established the Glasgow Financial Alliance for Net Zero (GFANZ) and, more specifically, the Net Zero Banking Alliance (NZBA), which "brings together over 45 banks from 24 countries with over $29 trillion USD in assets, which are committed to aligning their lending and investment portfolios with net-zero emissions by 2050".

Action gap

Unfortunately – and perhaps predictably – all of this UN action isn’t as brilliant as it sounds. For example, among the banks currently signed up to the NZBA are:

- Barclays: Since the Paris Agreement was signed in 2016, when 197 countries agreed to drastically reduce their greenhouse gas emissions, Barclays has provided at least $145 billion in financing for the fossil fuels industry.

- Bank of America: At least $198 billion in financing for the fossil fuels industry since 2016.

- Citi: At least $237 billion since 2016.

- HSBC: At least $111 billion since 2016.

- Standard Chartered: At least $31 billion since 2016.

Our recent blog post, Line 3: An Unthinkable Pipeline Powered by Our Cash, is just one example of major banks financing huge projects that will increase global temperatures.

These banks have had decades to do the right thing and stop financing a climate catastrophe. Why should we believe them now?

That's why we need to help hold them to account. In entrusting these banks with our money, we wield power that can help force change with the necessary speed. As the IEA says, "a transition of the scale and speed described by the net-zero pathway cannot be achieved without sustained support and participation from citizens."

Take action

Fridays for Future head and climate justice activist Alienor Rougeot running and participating in a climate strike [source]

The amounts of money that the world’s largest banks have at their disposal are unfathomable, their power supreme. There’s nothing we can do about that. So, what can we do?

There's plenty we can do to effect change, especially as a collective movement. Climate change thought leaders are characterizing COP26 as a fork in the road for all of us. Global change on the scale required is a lumbering juggernaut, which our collective efforts can nudge in the right direction.

Using COP26’s commencement on October 31 as a deadline, you can:

- Investigate your bank’s recent financing activities using our free bank-checking tool

- Contact your bank and ask them if they have a COP26 plan. Here's some inspiration:

undefinedundefinedundefined - Sign our pledge and commit to moving your money to a sustainable bank before COP26 begins on October 31 - When you sign the pledge, you can arrange for us to send an email reminder at a time of your choosing

- Visit our Take Action page for more detail on what you can do to help force change in the banking industry.

The time is now

Former US Secretary of State John Kerry with US Ambassador to Morocco Dwight L. Bush Sr. during COP22 in Marrakech, 2016 [source]

In January, the USA’s Special Presidential Envoy for Climate John Kerry stated that COP26 is "the last best chance the world has" to take action on the climate crisis before it spirals out of our control. That might sound like a Hollywood blockbuster-worthy soundbite, but the best available science concurs: this is our reality. Luckily, many of the people who can effect the change we need are talking the talk; our job now is to push them until they’re walking the walk.

Start to Bank Green Today

Banks live and die on their reputations. Mass movements of money to fossil-free competitors puts those reputations at grave risk. By moving your money to a sustainable financial institution, you will:

Send a message to your bank that it must defund fossil fuels

Join a fast-growing movement of consumers standing up for their future

Take a critical climate action with profound effects